As Shelby Foote said;

"Of all the passions of mankind, the love of novelty most rules the mind. In search of this, from realm to realm we roam. Our fleets come loaded with every folly home."

This could hardly be put more perfectly, and its application to trading and traders is beautiful.

Traders, novice traders in particular, spend incredible amounts of time energy and more often than not money, on the search for the holy grail of systems/indicators. They fly from one novelty to the next and each failure is simply a result of an imperfect system rather than a fault of the trader. How convenient.

Gann, Elliot, et al serve up a bewildering host of indicators, systems, sub systems, and meta systems which describe when to break certain rules of the system (which keeps this sort of fudging within the rubric of the system which is being broken)

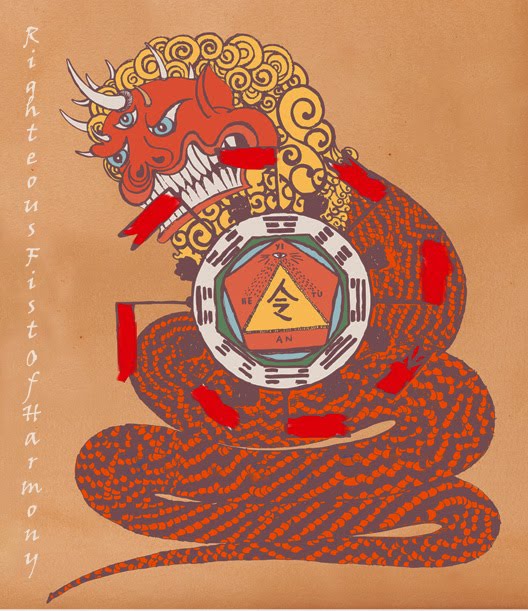

Case in point: Can you make a trading decision based on the information on this chart?

This comes from a confused and confusing human ostensibly named Kenny. He hosts Kenny's Technical Analysis Blog. A fools parade of noisy charts which he complains bitterly about, though of course he blames the markets choppiness etc, rather than his own fetishistic obeisance to the most venerable Elliot and his trivial waves.

Beware the siren song of novelty, the market is simple, complicate it at your own peril.

Wednesday, June 16, 2010

Tuesday, June 1, 2010

Trend or Revert

It's of critical importance for traders to identify the type of trade they intend execute.

Although it's easy to become mired in the vast universe of trading systems and styles, there is a underlying simplicity to the markets, which when taken into consideration simplifies the decision making process.

There are only 2 types of trades. Trades which expect to take advantage of a trend continuation. Or trades which hope to capture profits visa vi a reversion. By understanding this traders can make more cogent choices when selecting their criterion for the entrance and exit of trades.

For example, although it is possible to use MACD when hoping to capture a price reversion from a high, there are tools which are much better suited to this particular type of trade. Tools such as Bollinger and Starc bands.

Likewise using ADX to identify reversion trades is less than optimal.

Consider what you are hoping to achieve in a given trade and ask yourself which of the two types of trades you are pursuing. Once this is accomplished you will be in a much stronger position in regards to entry and exit positions.

Although it's easy to become mired in the vast universe of trading systems and styles, there is a underlying simplicity to the markets, which when taken into consideration simplifies the decision making process.

There are only 2 types of trades. Trades which expect to take advantage of a trend continuation. Or trades which hope to capture profits visa vi a reversion. By understanding this traders can make more cogent choices when selecting their criterion for the entrance and exit of trades.

For example, although it is possible to use MACD when hoping to capture a price reversion from a high, there are tools which are much better suited to this particular type of trade. Tools such as Bollinger and Starc bands.

Likewise using ADX to identify reversion trades is less than optimal.

Consider what you are hoping to achieve in a given trade and ask yourself which of the two types of trades you are pursuing. Once this is accomplished you will be in a much stronger position in regards to entry and exit positions.

Subscribe to:

Posts (Atom)